Which are the Benefits of Private Mortgage loans?

Once a potential borrower finds out a personal bank that meets the demands, the next phase is to apply for the mortgage. The application processes normally concerns submitting a credit card applicatoin detailing brand new implied utilization of the loans, brand new proposed payment package, and information regarding the property being funded. This is exactly markedly unlike a traditional application for the loan, the spot where the focus depends on the newest borrower’s credit rating, earnings, and you will full economic fitness.

Following software, the private bank often gauge the offer. It tend to comes with an assessment of the property to decide the market value and you will possible success.

Individual lenders legs the financing conclusion mainly toward property’s really worth additionally the borrower’s equity stake as opposed to the borrower’s creditworthiness. That it advantage-centered means makes private mortgage loans such as for example attractive to a residential property dealers and people with original financial situations.

Abreast of recognition, the loan terms was decided, and also the fund is disbursed. Just like any financing, it’s essential to see the terms of the borrowed funds totally, like the interest rate, cost plan, and you can any possible punishment to own very early cost.

You will need to keep in mind that personal mortgage loans generally have reduced words than simply traditional funds, generally anywhere between that five years, and you can hold high interest rates. The new borrower constantly renders desire-only monthly obligations, with an excellent balloon fee at the conclusion of the expression one to repays the main entirely.

Private mortgages are typically safeguarded because of the assets by itself. It means whether your borrower non-payments into loan, the lending company has the to need ownership of the house owing to a property foreclosure techniques.

Basically, individual mortgages offer an adaptable and you can expedited alternative to traditional funds. As they carry out feature a high prices, they can promote important capital whenever rate and flexibility try paramount. Very carefully remark the money you owe, possessions financing means, and a lot of time-title expectations in advance of opting for a private mortgage loan.

Individual mortgages render several distinctive line of advantages to prospective consumers, especially for men and women doing work in real estate assets otherwise trying book financial support selection.

step 1. Less Acceptance

Unlike traditional lenders, personal lenders often bring a more quickly acceptance process. When you find yourself a traditional home loan might take weeks otherwise months in order to become approved, personal loan providers can sometimes offer acceptance in 24 hours or less. It is such useful when aiming to safer a house inside the an aggressive markets otherwise having to refinance a preexisting mortgage swiftly.

2. Flexible Terminology

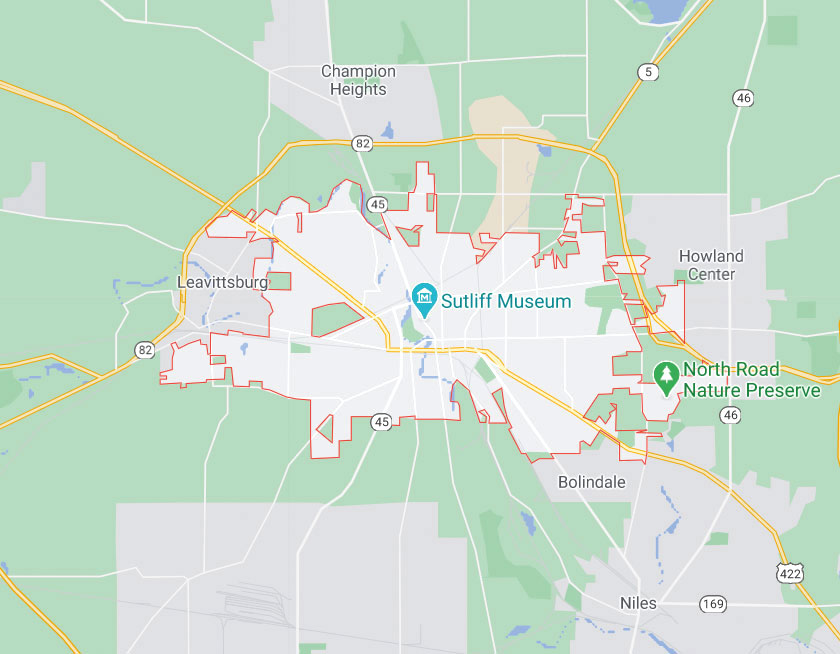

A primary advantageous asset of private financing is the liberty for the loan terms. Private lenders convey more independence which instant same day payday loans online Washington will make financing that fits the brand new borrower’s particular means, considering aspects such as the installment plan plus the loan’s goal. Which independency is specially useful the real deal home dealers interested in creative capital choice one to a timeless lender may well not bring.

step 3. No Credit rating Demands

Antique lenders essentially base its financing decisions heavily into the borrower’s credit score. Alternatively, private mortgage lenders will notice on the value of the fresh real estate getting financed therefore the home equity this new debtor has actually on the assets.

This makes private mortgages a practical selection for individuals with less than excellent credit otherwise bizarre money supplies that may endeavor which have being qualified to possess traditional mortgage loans. Those who are thinking-functioning otherwise real time outside the All of us come upon one to roadblock having antique mortgage loans frequently.

cuatro. The means to access Resource

Individual mortgage loans offer the means to access ample quantities of resource, specifically for home people. Whether you’re trying to finance home, industrial assets, or home to have invention, personal lenders usually can money considerable a property deals which could become beyond the extent of traditional finance companies.