When you should think an unsecured loan getting 550 credit history

If you cannot rating a consumer loan, you might have to discover a guaranteed alternative who does wanted one to keeps collateral.

Personal loans helps make a great deal more sense in certain situations than others. Looking at your local area financially makes it possible to decide if financing is the best bet for those who have a 550 credit history.

Unsecured loans makes it possible to economically regarding small and you may long identity, however, getting one having a 550 credit score either means a lot more time and determination. You might be able to get accepted for an unsecured loan in the realistic words, but it’s important to considercarefully what will come second.

Including choosing how you will employ the borrowed funds loans as well as how you are able to pay them back. When you are paying a higher level getting a consumer loan since the regarding a 550 credit history, investing it off sooner rather than later helps you to save some funds. Here are a few tips for quickening your loan payoff.

- Shell out biweekly, which adds up to that more financing percentage per year.

- Explore windfalls, for example taxation refunds otherwise performs bonuses, making lump sum costs to the dominating.

- Build most micropayments out-of $twenty-five otherwise $50 month-to-month so you’re able to processor away at the equilibrium.

If you don’t have an emergency economic you would like, you can also wait to try to get an unsecured loan until your credit rating advances. Entering the newest 600+ range, such as for instance, will make a difference in the financing cost and words you’re able to be eligible for.

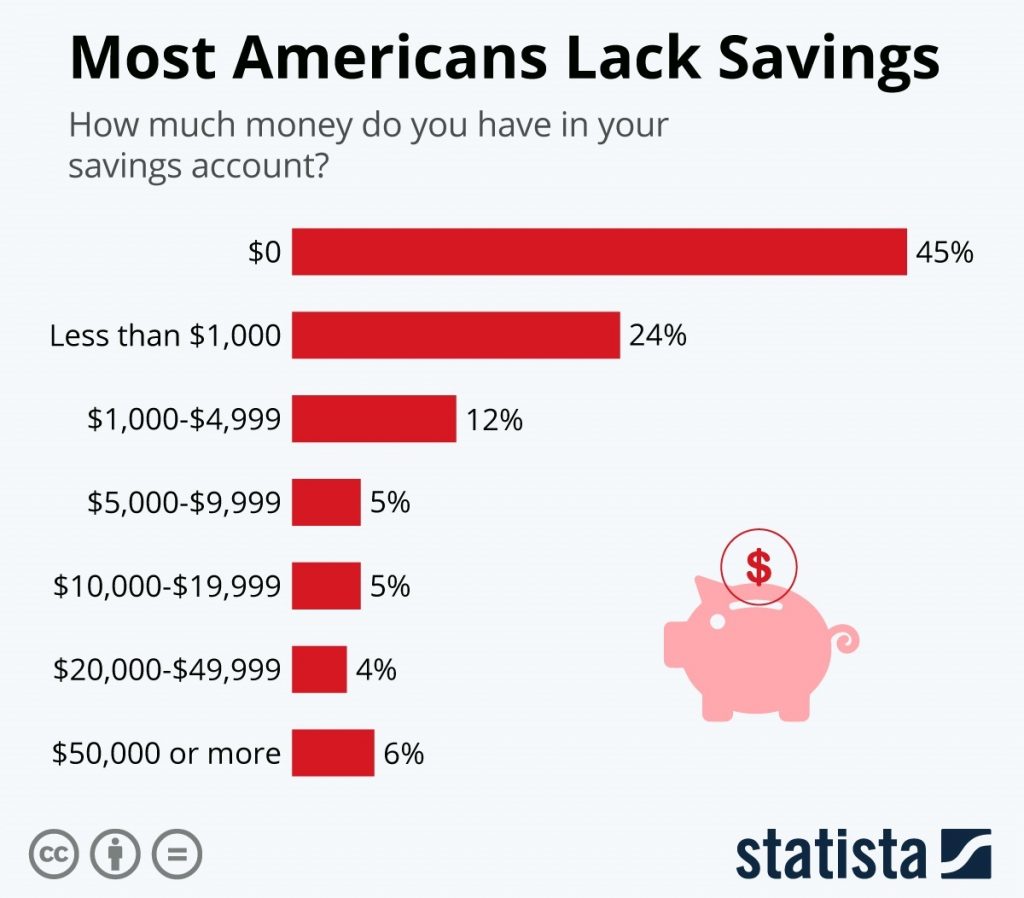

A credit score away from 550 is known as terrible. If the score is in it range, I would suggest understanding how it fell to this peak and working to your improving your rating over the years. In some cases, it could be an issue with your finances, so focus on increasing your income (when needed), saving cash, and you will saving way more that you do not put yourself in a position the place you are unable to would financial obligation sensibly.

Alternatives to help you unsecured loans to possess a credit rating lower than 550

You have got alot more choices than you are sure that to help you secure the fund you prefer. Let us mention choice to signature loans.

Secured finance

As opposed to unsecured personal loans, secured loans require security, particularly a home or a motor vehicle. This are going to be practical to own a borrower that have a great 550 credit score as the guarantee decreases the lender’s exposure. Although not, the collateral was at risk if you can’t repay the mortgage.

Borrowing from the bank builder money

Credit creator financing will likely be an alternative choice to alter your borrowing from the bank get when you find yourself borrowing. These are generally made to assist individuals create borrowing from the bank from the reporting uniform into-time money so you can credit reporting agencies. However, loan providers have a tendency to usually support the amount borrowed up to you completely paid down the loan.

Pay-day solution finance (PALs)

Family is short, short-title finance supplied by some federal borrowing from the bank unions. They’ve been customized because the an affordable replacement highest-costs payday loans. They’re essentially way more available, nevertheless limit amount borrowed is limited, and you should be a person in the credit partnership providing it.

Cosigned otherwise co-borrowed money

A beneficial cosigned mortgage otherwise co-borrowed financing pertains to someone-in this case, that have a far greater credit rating. An excellent co-debtor is equally guilty of payment, and you can an excellent cosigner believes to repay the mortgage or even. This can lead to a lower life expectancy interest rate, however it towns financial stress on the cosigner.

Peer-to-fellow (P2P) lending

P2P funds are from private people in the place of conventional creditors. This can give a great deal more loan possibilities having straight down-credit score consumers, but the financing might have high interest levels and more strict terms.

Fund from members of the family or family unit members

Borrowing out of family and friends is an option whenever conventional financial loans are not available. This really is advantageous due to possibly versatile terms and conditions and you can nonexistent attract, however it can be filter systems dating if you don’t handled properly.