That it first browse listing happens regarding Financial of The usa so you’re able to NACA

- Re Condos: Means 51 % owner occupied on the complex w lower than 10% of tools delinquentplex shouldn’t have to feel FHA accepted.

- Not just for very first time homebuyers: Domestic client do not own an alternative piece of property when searching the fresh new NACA mortgage. Note: the new Homebuyer Normally very own property otherwise timeshare since the we can not owner take all of our property or timeshare.

- If the to buy a short sales, NACA customers do not pay the seller’s charges in addition to one third party quick business negotiator percentage

- No income limitations

- No time limit required to stay-in your house

- ITIN (private taxpayer ID matter) okay

- As well as get: blended have fun with commercial-home-based

- Visitors pays for domestic examination

- Dont play with a great NACA loan purchasing assets on a property foreclosure public auction.

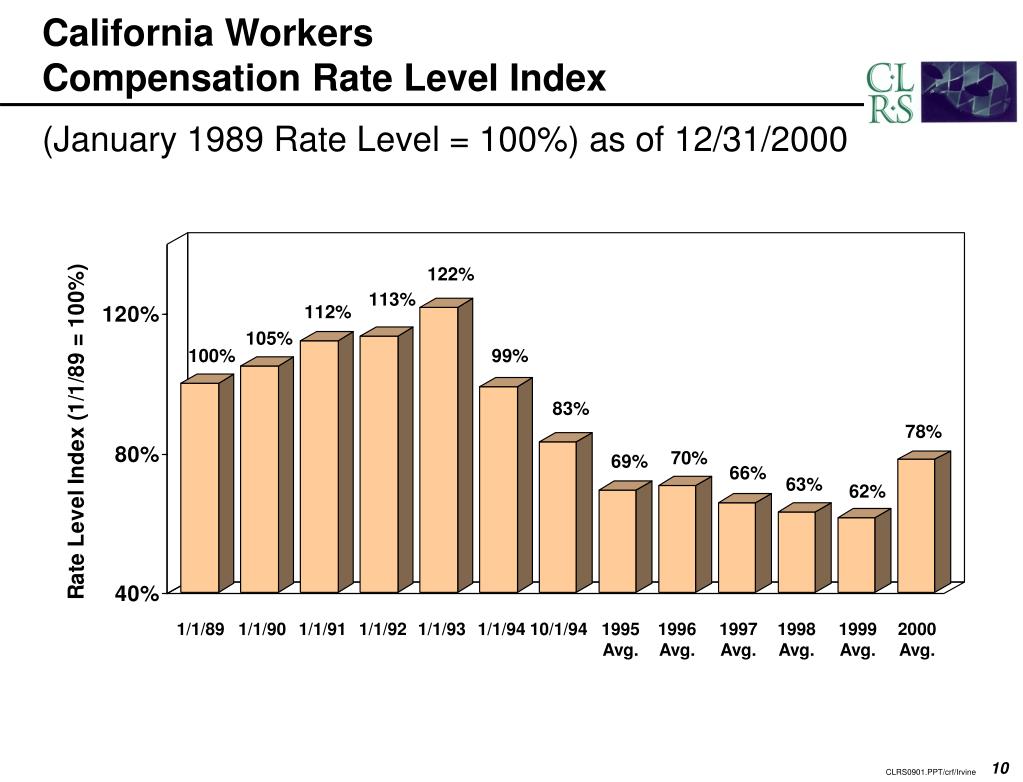

At the peak of the crisis/homes reset, subprime loans non-payments went as much as forty%

Real estate brokers Real estate agents go through an effective NACA studies system. As the NACA does loads of homebuyer outreach degree, in the event the a purchaser try referred regarding NACA towards the a house broker then the a home broker will pay a recommendation percentage to NACA off 33%. They don’t but really features a bona fide estate licenses inside WA Condition but will quickly and you may stated client representative symbol within their mission having WA County. The a house representative program is not installed and operating yet , nevertheless NACA representative states preparations are located in destination to offer the application to the Seattle/Tacoma urban area in the near future.

REOs: 14-Go out Very first Search w/BOA NACA-acknowledged home buyers has a private solution to get REOs off Bank from The united states prior to they are listed in this new Mls. Never assume all REOs, and not all of BOA’s REOs…some. NACA sends the latest REO record to Real estate professionals affiliated with NACA. BOA has actually about three BPOs done to dictate the purchase price. Selling representative ensures NACA-acknowledged visitors is meet the requirements. In this case, then your NACA-accepted customer can view the home prior to it being noted on new Multiple listing service. If an excellent NACA-approved buyer submits the full list rates provide in the fourteen date first search screen, then the give must be recognized from the BOA, in the event other now offers try highest. On the other hand: In the event that NACA-recognized visitors makes the full rates render inside the earliest 14 weeks….have you been sitting down? Get this to a BOA gives 10 items to the buyer to get along the interest rate. Normally step one point = .25 out-of a performance buydown so this means brand new NACA-accepted visitors could end up with a two.5 percentage area interest rate buydown.

Zero-down-less-than-perfect-credit in addition to feels like a beneficial subprime borrower

NACA Homebuyers Is Greatly Counseled The bets is against the NACA borrower. Zero down, less-than-primary borrowing sounds like your normal FHA debtor using present fund on the downpayment. And you can already FHA’s default speed try fifteen%.

Why should NACA’s standard rate become any shorter? Here’s as to the reasons: This new NACA borrower encounters heavier pre-pick guidance and contains accessibility just after-buy standard assistance services eg advice about forbearance/cost preparations and you may loan mod support. Additionally, for those who have a NACA mortgage and you’re in financial distress, you might located Richmond installment loans bad credit step three monthly payments paid down by the NACA to take your loan off default.

Therefore what’s the connect? NACA homebuyers have to signup NACA at a high price out of $20 four weeks while they’re planning pre-homebuyer guidance kinds and then the costs is $fifty per month for 5 age ($step three,000.) As well, NACA property owners need to commit to take part in 5 NACA facts per season. Points include area volunteer work, hosting a beneficial NACA conference in the region, tossing good homebuyer working area, doing advocacy tips facing predatory lenders, and so on.