Generally, Ben lends their insider’s perspective on the loan mod process to assist residents create a beneficial behavior

Due to the fact an old financial banker and prominent out-of Castle Rules Category, Ben suggests customers on their possibility of searching financing amendment helping present criterion regarding your likely regards to financing amendment arrangement. Ben and suggests customers concerning you are able to options for escaping . of around their upside-off financial entirely and helps clients make and apply method regarding a comparable.

Discover The possibility

Of numerous consumers who will be looking to financing modification dont presently be eligible for loan modification sometimes due to jobless or in contrast, as their money is a lot better today than just once they obtained the loan to begin with. Once again, judge influence may be beneficial right here. Consumers which contest a foreclosure suit have a much high possibilities out of protecting financing modification than those who overlook the lawsuit. Disregarding the fresh new lawsuit is a decision that have long-lasting negative effects.

Know The choices

Loan mod is not the only option. Ben educates website subscribers towards the other available choices so you can get from not as much as a keen upside-down home loan and you can avoiding deficiency view. Since Loan mod, Deed-in-Lieu, Small Sale, and you can Foreclosures by way of Strategic Standard are not collectively personal procedures, this has been beneficial to features a multiple-faceted proper approach.

Frequently asked questions

What exactly is a loan amendment or loan mod?That loan modification is actually an official authored agreement to change the brand new regards to financing. That loan amendment can sometimes were a reduction in the attention rate, an ever-increasing the phrase or duration of the loan. That loan modification also can become a primary equilibrium cures.

Do i need to be delinquent towards lender to be effective beside me?New quick answer is yes. Although not, certain loan providers create run borrowers who aren’t unpaid. Likewise, certain regulators-backed programs wanted individuals to get latest on the costs. It is very vital that you understand the ramifications regarding neglecting to make repayments not as much as a great promissory mention. Failure and then make costs try violation regarding bargain and can more than likely enjoys extreme bad outcomes in order to a great borrower’s credit score. Consult with legal counsel that will walk you through the dangers of becoming outstanding.

How long really does a loan modification simply take?Loan modification is going to be an extended process, providing from around a couple of to 8 months or perhaps ten years when you are refused and re-apply several times.

What is an excellent HAMP mortgage loan modification?HAMP, and/or Home Affordable Modification System is perfect for individuals who are utilized but nonetheless struggling to make month-to-month home loan repayments. It may lower your month-to-month mortgage payments. Of a lot higher loan providers participate inside the HAMP, not, of many higher lenders likewise have their unique mortgage loan modification programs.Reference:

Shielding a property foreclosure match can provide not just courtroom control but together with time to score financing amendment, in order to make a preliminary marketing or to stop an insufficiency.

A deficit judgment can last doing 20-decades unless reduced otherwise solved. A deficit view should be a beneficial lien toward all low-homestead a house or other property.

Even if you well qualify the lender special info shouldn’t have to modify your specific loan. Lenders don’t customize everyone’s mortgage; it’s just perhaps not economically possible.

Palace Legislation Class assists website subscribers determine whether an initial selling are right for them from the outlining the dangers and you can prospective rewards relative to our clients’ unique financial predicament.

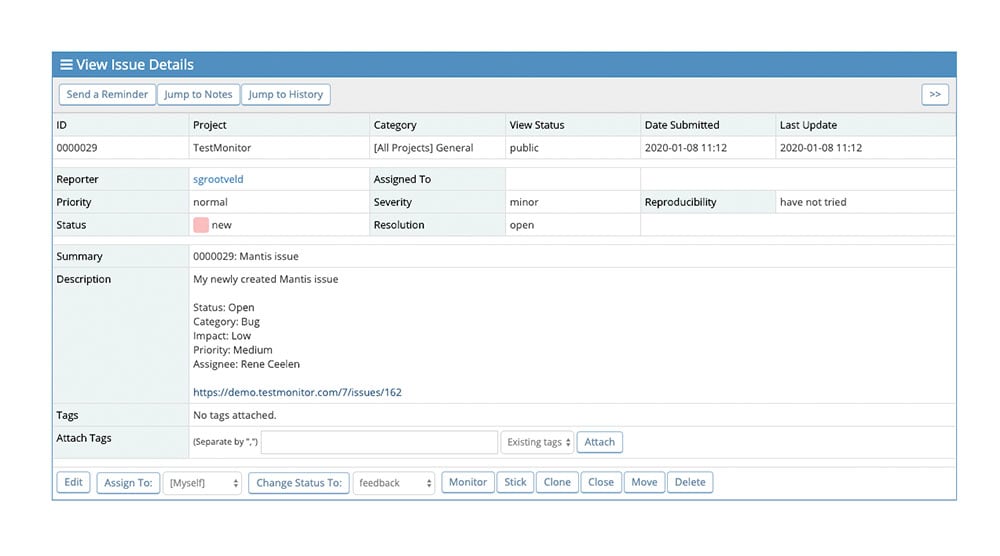

- Make an application for aloan modification. To try to get a loan amendment, require or down load the fresh new lender’s loan modification application and fill it and you will gather the desired duplicates of the economic pointers. When you are mind-functioning, discuss with an experienced attorneys. The aim is to score that loan modification one to pros your perhaps not the lending company. In addition, a loan mod software program is not a substitute for replying to a foreclosure complaint.