Not totally all mortgage brokers give FHA loans, so the initial step is to get one who do

Property Criteria: You can use an enthusiastic FHA financing purchasing a property that have normal wear however one to with big architectural or questions of safety. Particularly, your roof need to be for the good condition, and also the household can not be close an unsafe waste venue.

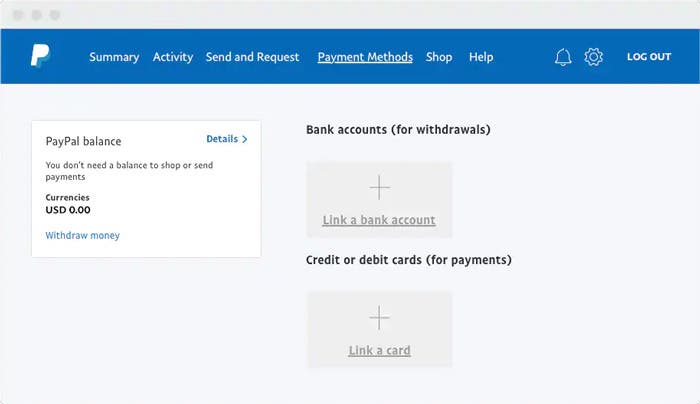

How to get A keen FHA Mortgage

Provide monetary papers: For example the recent pay stubs, W-2s, tax statements, checking account comments, plus. The loan manager will say to you the actual data you will need to incorporate, therefore we’re going to be there to you every step of your method.

Wait a little for your residence assessment: Property appraisal ensures you reside really worth the amount of money you want to in order to obtain because of it. During this time period, the newest appraiser usually view so that the property match FHA design and you will habitability guidelines.

Keep in touch with the loan administrator: On BluPrint, we are all on best interaction. As your financial are canned and you may underwritten, your loan manager may require extra paperwork in the process. We will kept in close experience of your each step of the treatment for make certain you’re in new circle all of the time.

Attend the closure conference: The last step! This includes paying your closing costs and you can deposit too due to the fact having your tips. To-be extra ready to accept your loan, click on this link.

Final thoughts

When you find yourself debating the advantages of a keen FHA mortgage compared to a traditional loan, be aware that a normal financing isnt government-recognized. Old-fashioned finance are offered as a result of Fannie mae or Freddie Mac computer, that are authorities-sponsored companies that provide financial loans so you can loan providers. He has so much more standards, very remember that needed increased credit history and you may a lower life expectancy DTI so you can qualify. One more thing to keep in mind is actually FHA finance are generally top fitted to very first-date homebuyers, customers having a credit history lower than 620, otherwise buyers finding a low advance payment alternative, when you are traditional loans are a great complement consumers having a good credit history above 620 otherwise a house investors.

Whether or not you select a normal otherwise FHA loan, remember that there are a few most other cash advance loan Meeker will set you back to keep in brain. You will have to shell out settlement costs, do you know the charge of this running and you will securing your loan. Such closing costs are essential however, will vary according to price of the home plus the particular financial. It’s recommended that your budget step 3% 6% of your own residence’s value. BluPrint Home loans partners with many additional deposit guidance programs that can assist using this bit, but you’ll need to talk about those possibilities which have certainly one of the specialist Loan Originators.

It’s also wise to budget 1% 3% of one’s cost having restoration. The particular commission is just about to depend on age our home. In case your residence is latest, the odds is actually fewer things are planning to crack straight away. Yet not, if for example the house is on elderly prevent, you may need to arranged way more. Ultimately, if you reside in the an area which have property owners organization charges, you’ll be buying the individuals on a month-to-month otherwise yearly base.

While looking for a loan that have lenient credit, reduce commission, and you may lower-to-average earnings conditions, a keen FHA financing might be best for you. Here are some your options here.

Credit limit: The latest FHA restricts simply how much you might acquire. The restriction utilizes where you live and what sort of property you order. Such as, the latest limitation to possess a two-family home for the Los angeles vary than for an excellent four-house in Orlando. Enter your state and county information to see your own credit restrictions towards the All of us Company of Casing and you can Metropolitan Development web site.