Data files Expected Whenever Making an application for FHA & Virtual assistant Mortgages

Home loan Insurance coverage

The next most significant advantageous asset of Va funds is the fact that whatever the down payment a seasoned chooses to have fun with, there is no home loan insurance rates on the Va loans. It work for by yourself saves experts several thousand dollars in one single 12 months.

In the https://paydayloancolorado.net/evans/ event the a seasoned was buying a property to have $2 hundred,000, and if rates of interest and you may everything else is the identical, the amount of home loan insurance policies and that’s charged to your FHA mortgage, and therefore does not can be found on Virtual assistant financing, is approximately $137 /day. This one thing results in

And this refers to maybe not looking at a chance cost and you will just what you to definitely count month-to-month can truly add around in the event that invested in other ways.

Trying to get FHA & Virtual assistant Mortgages

One of the largest differences when considering FHA & Virtual assistant is approximately who is said to be to the mortgage which help meet the requirements. In which FHA finance were made to assist Us americans qualify buying property, by letting low-owner occupied individuals assist in a buyer qualifying, Va fund don’t have that it liberty.

Va loans are tight to your that is said to be with the a good Va loan. Just the Veteran and you may a spouse are allowed towards Virtual assistant money. Veterans usually do not request to possess its bride-to-be, mothers otherwise youngsters into Va loans.

Income & Business Conditions

There is an explanation as to the reasons Virtual assistant money get one of one’s lower default rates of any type of home loan at this moment, and is also by the assistance set around money.

Assets Inspections & Appraisals

A different sort of difference in these two regulators finance is the Appraisals and inspections required. When you’re both FHA and you can Virtual assistant enterprises focus on protection whenever insuring a beneficial assets, there are some problems that simply affect you to and/or most other. Listed below are some examples of certain variations.

Ultimately, this new assessment possession is quite some other to have FHA and you may Va financing. Whenever a property happens around offer which have an FHA consumer, our home was tasked an FHA instance number. The assessment are recognized with this situation count and also the statement and value are associated with that family getting 120 months, regardless of if one to customer guides out and you can a different buyer requires more than. An identical appraisal is employed in the event the playing with a keen FHA mortgage.

A good Va assessment is not attached to the assets, but instead on the Seasoned. Va funds have some really glamorous appraisal flexibilities off most of the loan models on the market. In the event the appraisal return additionally the worthy of are reasonable, the fresh veteran is consult this new Va to review brand new assessment that have a second appraiser. Whether it second appraiser agrees with the fresh new experienced, the fresh new Virtual assistant will guarantee a lender, even with a decreased assessment.

Assets Brands

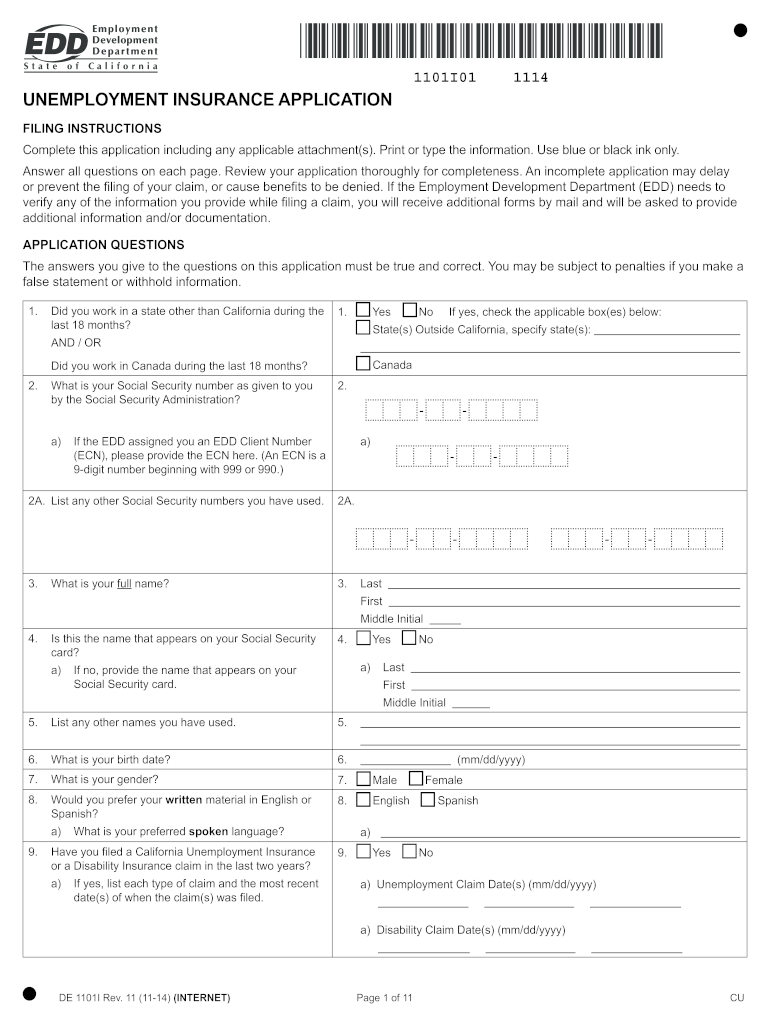

Most of the time, the fresh new papers is the identical whenever making an application for an FHA and Virtual assistant financing. The difference is available in toward Virtual assistant homebuyers that have to help you confirm that they’re eligible for Va masters. This is accomplished by giving:

- DD214

- Certificate away from Qualification

- Nearest Living Cousin

Number of Money Invited at the same time

There’s a lot out of misunderstandings doing how many FHA and you will Va financing someone is allowed to hold at the same time. I will provide the respond to here, then again explain the grey section that an effective mortgage officer could work within this.

To own FHA fund, HUD doesn’t for example one to homeowner to have several FHA mortgage immediately. It is because the newest FHA loan is designed to be taken while the a proprietor-filled investment choice. When you have a couple belongings, included in this is not much of your house. In which the gray town will come in is when you should pick a new assets also it would-be tough or perhaps not seem sensible to market your current household.