And our very own system is actually brand new Chuka Chukmasi Home loan Program

It weren’t undertaking enough financing once the, truth be told, although there try exposure-share preparations positioned

Kay Perry towards Chickasaw Nation’s Property Counseling and Financing Solution system brings an introduction to the Chuka Chukmasi Financial System and exactly how the application form spends people and you can financial resources intelligently.

Perry, Kay. “Chuka Chukmasi Home loan Program.” Celebrating Nations symposium. Harvard Investment towards American indian Financial Innovation, John F. Kennedy College or university away from Bodies, Harvard School. Cambridge, Massachusetts. . Presentation.

“Well, they’ve been an arduous operate to follow along with, however, I am going to query Kay Perry regarding the Chuka Chukmasi Mortgage Program ahead send and to discuss the application form truth be told there and possibly a number of the other things are going with the from the Chickasaw, again with this specific work at permitting you contemplating playing with economic and human resources intelligently on to the floor. There are a lot of samples of that on cultural safety example we just spotted.”?

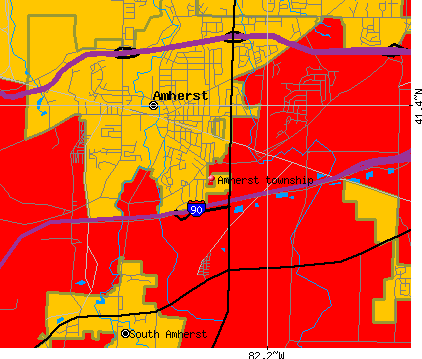

“I’m Kay Perry and you will I’m Manager of Homes, Guidance, and you will Loan Properties Agencies into the Ada, Oklahoma. I think that each champ here, the concept started someplace that have a flame that simply particular burnt within and there are common kinds of apps — can everyone tune in to me? I am unable to give. Okay — that will be champions, but a thought was required to initiate someplace, and i know for my situation, home ownership are a fire that was types of inside me since the I was raised extremely, really, less than perfect and i also assume I happened to be a great freshman inside the university ahead of my personal mothers previously had its earliest domestic. And i can be think of expanding upwards, thinking that those who possessed their land was in fact steeped and you will they had money and you can, ‘Gosh, would it feel nice getting a home of in lieu of living in lease properties where curtains blew out about cold weather by the wind to arrive up to all of them, otherwise which were up on concrete reduces, don’t have even foundations.’ And that i is also think of growing right up this way and you may thought that individuals which possessed their homes was steeped. And i can still think about which have you to interest, whilst a tiny kid getting property away from my personal individual.

It had been a complete-paperwork mortgage, it absolutely was underwritten by human beings, of course We continued panel, just after it had been around for several many years, i weren’t carrying out a number of loans

And you will I’ve actually spent some time working on the financial credit world to own 31 years now and i also spent some time working mainly during the banking companies. I have already been towards the Chickasaw Nation getting a little more four-and-a-50 % of ages and i also has worked in the banking institutions and i also spotted the inequities in credit, so there was indeed of a lot inequities from inside the credit, therefore was constantly the fresh minorities you to definitely one inequity try shown to your. And that i can still think of disliking they. And you can I am honest along with you, You will find also forgotten one or two perform just like the I am fairly outspoken while the We spoke upwards throughout the one particular inequities. I decided to go to work for new group five-and-a-1 / 2 of years ago and also the Chuka Chukmasi Financial Program try already around and has grown up enormously since the 1998, whether it started. And if it first started, it had been a collaboration ranging from a broker, PMI home loan insurance provider and Freddie Mac — in reality began is a beneficial Freddie Mac computer loan, Freddie Mac computer is a trader — and it are the beginning. and there remained those individuals inequities because the probably the underwriters were active in the underwriting procedure and you simply nearly had loans De Beque CO to getting a perfect candidate becoming acknowledged for a financial loan. The loan expected guidance, however, during the time it absolutely was complete over the telephone with a buddies that has been contracted. I talked in order to applicants. It spent regarding the 10 minutes towards cell phone together and you may they signed of on a sessions part. Well, you to definitely don’t make me delighted.