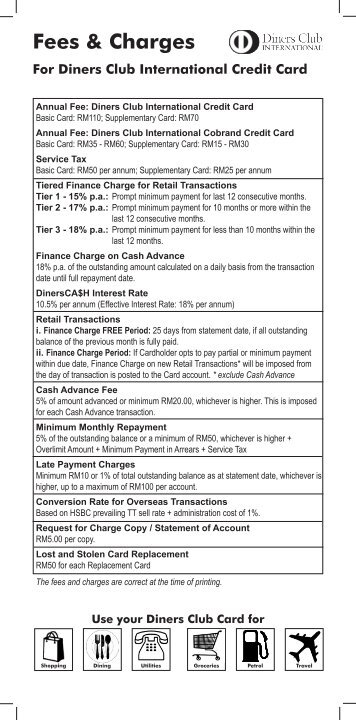

Fees and you may charges to watch out for

Lower than is actually a list of the sorts of visas which can be acknowledged because of the loan providers to own home loan software since proof of the judge residency:

- H-1B or any other H show visas including H-1C, H-2, H-step 3 and you will H-cuatro

- E series

- Grams show

- L show

- O series

- NATO collection

- Canadian and you can Mexican NAFTA collection

Please be aware that it’s not necessary for a B1/B2 charge, since a la is suitable likewise to own an upwards to six day stay in the united states in just about any 12 few days period.

The fresh new costs that you will be subject to lies in your role. It can are different anywhere between states, venue and you will what kind of construction you are considering to get. Eg, domestic property inside the a location particularly New york incorporate prominent fees and you can month-to-month charge, when you will be looking at mortgaging a great co-op apartment otherwise condo, its worth understanding that it isn’t just the initial income rate that you will be responsible for.

The lending company won’t accept Draw making getting 6 months away of the season to a different nation if you find yourself owing on the a great pending financial

When selecting a house in the usa, you need to take into account the coming and you may what you would need to understand in regards to ever-moving once again or offering the possessions https://paydayloanalabama.com/north-johns/ towards. To possess foreign citizens, its mandatory your Internal revenue service keep back fifteen% of one’s final purchase price. Failing continually to accomplish that can lead to you expenses a lot more, so many fees. People from other countries offering assets in america are susceptible to expenses Financing Increases Fees.

Possessions taxation are different massively out-of state-to-condition. Possessions taxes are calculated a year based on an examined property value homes and you will formations you very own. Its value giving that it some consider whenever erica. For the easier terminology, if you want nicely separated houses in the middle of an abundance of belongings, you may want to thought moving to a state having a great down property taxation price!

Escape residential property

A lot of people love the idea of leaking out standard and achieving the next domestic someplace for instance the United states of america. Naturally, its a choice… yet not somewhat an easy one to. Lower than was a good example condition of a few secret points to look at:

Mark is on the United kingdom. The guy wants to buy the next possessions someplace in the usa to escape a cold, bleak wintertime having half a year from the year.

The initial thing getting Draw to take into account is the visa that he needs to submit an application for. You might submit an application for a good B1/B2 seeing charge for approximately 6 months, but it’s perhaps not protected it might be provided. Its easier to to have whenever you are resigned, in lieu of Mark who’s nevertheless doing work.

Just like the a non-resident, people get you to Mark desired to generate to your a house manage must be an upfront cash-pick. To have home financing on this possessions would mean however need to make they his head home, which could build their vacation-house dream unachievable. Mortgage loans also require that feel existence when you look at the You during the general, to continue to repay your residence-mortgage.

An alternate challenge to adopt will be medical insurance. In The usa to have six months out of the year do need you to definitely was indeed safeguarded in the event your even worse was to happen. Besides, pre-current health problems will never be cost effective to insure. These materials are very important to policy for to be sure the guy remains affordable.

There are plenty what to think of when selecting assets in the usa, although the just for an associate-time split! Considered and being advised is vital, and you should usually find expert advice.