Financial support Multifamily Residential property that have a great Va Mortgage

How Va loans can be used to finance multifamily belongings

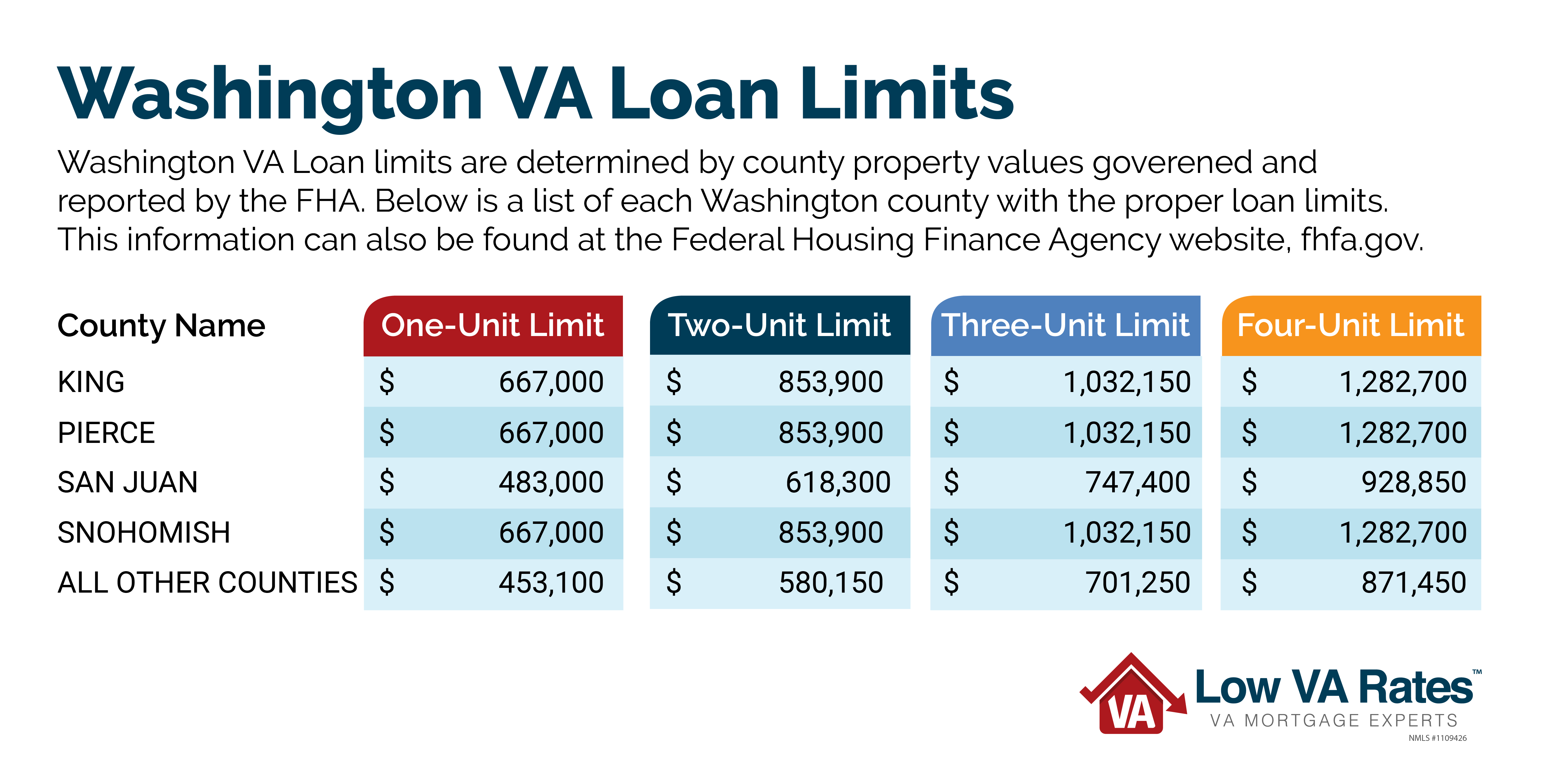

Could i feel recognized for a good Virtual assistant loan to own multifamily belongings and you may/or local rental property? The answer is actually trickyit is possible for a Va borrower to try to get a loan purchasing a house that have as much as four traditions systems. This new debtor must inhabit the house since the top house, although holder is free of charge in order to book the newest unused lifestyle units.

There is absolutely no such matter since good Virtual assistant loan to have multifamily residential property by itself. All Va mortgage loans was unmarried-home finance accepted for approximately five life style equipment. You will never end up being acknowledged to own a beneficial Virtual assistant home loan to buy possessions that you don’t plan to privately reside in as your street address.

When you find yourself eligible for a Va mortgage you could potentially imagine to buy a multi-product property to become an owner-occupier property manager.

People who make an application for a beneficial Virtual assistant mortgage that have a separate seasoned (a good Virtual assistant mutual mortgage) are enabled even more units to possess organization purposes, so your multiple-device possessions have over four equipment. Chapter Eight of the Virtual assistant Lender’s Manual clearly states:

If a property is to be owned by two or more eligible Veterans, it ily tools and something team unit, plus one extra tool for each and every Seasoned engaging in the newest possession.

Meaning for those who and something veteran submit an application for a Va home loan together you could potentially build otherwise buy a home that have because the of a lot since half a dozen relatives equipment (the fundamental five gadgets plus one tool for every single of one or two Experts), and one company device.

Having Virtual assistant mortgage loans you may also be permitted to consider possible local rental earnings because a qualifying foundation for the home loan.

Factors to meet the requirements while using Va finance to have multifamily land:

- The particular owner has to make loans Notasulga no credit check certain the guy movements towards the certainly this new units inside the only two months of the purchase.

- Almost every other economic enterprises instance FHA and USDA allows financing towards the restriction quantity of cuatro units. Any number past who enable it to be a professional possessions. But in the way it is out of Virtual assistant, it’s possible to capture for more than 4 together with other someone offered it be considered since a qualified person.

- In the case of 2 experts buying the assets to one another playing with the eligibility, the property may have 4 residential tools and you can step one organization tool. it may have one a lot more additional device which could be during the combined possession. This will make the complete tools are 6.

Believe regarding local rental income:

Va financing regulations allow it to be veterans to shop for home to provide potential leasing money out-of unoccupied systems is considered as home financing fee counterbalance having mortgage recognition intentions.

Va financing regulations declare that the lending company cover anything from prospective Virtual assistant loan rental income in the event the financial decides that the borrower features a good probability of triumph just like the a property owner centered on Section Four, together with debtor have to have cash reserves having fund to possess at minimum 6 months regarding Virtual assistant home loan payments.

All you have to discover qualifying having good Va financing with leasing income

Va financing statutes from inside the Chapter Four out of Va Pamphlet 26-7 (New Virtual assistant Lender’s Guide) say lenders have to gather specific records in the candidate inside the cases in which certain or every money a borrower provides is produced from leasing characteristics. You will be questioned to include particular files to show moneyleasing arrangements, confirmation of one’s leasing counterbalance of the house (just before pick and you may occupancy because of the customer), etc.

Va mortgage laws and regulations teach the lender to Use the prospective local rental earnings in order to offset the homeloan payment into the rental possessions, and just if there’s perhaps not an indicator the property would be difficult to lease. Which local rental income might not be used in productive money.

- You really must have had a beneficial multifamily home in the past.

- For those who have prior experience with handling multifamily residential property throughout the early in the day.

- If you have earlier expertise in gathering property accommodations.

- If you were employed in during the last the possessions repair character.

In the case of a currently leased-out possessions, 75% of the verified book amount is generally accepted as leasing earnings. In the event your mortgage is actually removed a house which is however regarding proposal means and never but really filled, this new appraiser should upload a page towards the Virtual assistant and therefore identifies, what’s the Reasonable Leasing Value’ of the property.