Funds having homeowners: Ideas on how to use and you will be considered

Regardless if you are trying loans renovations, consolidate unsecured borrowing or launch some of your security a resident Financing can help you make it.

Prior to taking you to definitely aside, it is important you make the best economic decision. That means understanding the financing process as well as the procedures that must be used to apply and you will be eligible for that loan.

What is a homeowner Financing?

A resident Financing also known as a protected loan otherwise second charges home loan makes you borrow cash using your possessions as security.

Fund to possess residents are around for British residential financial people, even if your credit Oklahoma title loans report isn’t perfect. You could manage to borrow way more during the a lowered interest rate than other sort of loan. The total amount you are permitted to obtain is based on the benefits of your home.

There are numerous reasons somebody remove Homeowner Finance consolidating expense, doing household renovations, getting married, if you don’t resource an excellent child’s training. Whichever it could be, a resident Mortgage will be the services you’ve been trying to find.

As with any loan, means having warning and research your facts. Ask yourself in the event that you’ll follow the fees terms and conditions.

It is necessary you usually shell out timely having a homeowner Mortgage, your residence was at stake if not. It is better to talk to a brokerage first they’re able to recommend the right selection for your. It’s also possible to play with a homeowner Finance calculator to see just how far you could obtain and you can wind up spending.

Who’ll make an application for a citizen loan?

Become qualified to receive a citizen mortgage there are packages you will want to tick. You ought to individual property. It must has actually an outstanding mortgage, and get adequate security so you’re able to borrow secured on.

Security is the difference in the market industry value of your property while the harmony leftover on your mortgage. The amount of equity you may have commonly apply to exactly how much your is use, and amount of fees you will be given.

Just what criteria perform loan providers examine?

All loan providers possess their particular criteria, however, here are some of your chief things it imagine when determining the application:

Industry property value your house will yourself change the amount you could use. A higher property value mode a top prospective amount borrowed.

Guarantee ‘s the difference in the market industry worth of your house in addition to equilibrium leftover in your mortgage. More security you’ve got of your house, the more glamorous you’ll end up to a loan provider. For the reason that there can be reduced exposure in their eyes.

Loan providers are often check your credit score to understand your financial background. Have fun with an internet equipment such as for example Experian to check your own personal just before applying this won’t affect their rating. But if you do submit an application for that loan and therefore are turned off, it may have a bad affect their get.

Loan providers are often require individual and you may house income prior to giving financing. This might be to make sure you can meet brand new costs.

They’ll also want to learn about your own almost every other typical costs financial, fund, trucks to the lease, an such like also exactly how many dependents you’ve got. You will be questioned provide proof, thus never ever go overboard your income otherwise play-down your own monthly costs.

Exactly what data files do you need to own a homeowner financing?

Proof of house a current utility bill or financial report will help prove your live the place you say you reside. If you don’t have such, you may need to have homes registry files or financial comments.

Proof income any current invoices otherwise payslips will likely be adequate. If you’re mind-functioning you may want to add your own most recent income tax go back.

Bank statements to help your own lender know your income and expenses. You will need to render about three months’ comments with the intention that you happen to be able to afford the mortgage.

Credit history they ought to be in a position to inspect which on their own. On the very uncommon occasions you may need to promote their credit report, you can aquire that it out-of a credit source service.

What else do you want to envision whenever trying to get a beneficial resident loan?

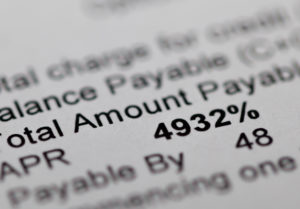

Rates of interest just like any significant monetary choice, never just fit into the initial quotepare as numerous additional offers as possible before making a decision.

Financing payment terminology find the of those that make the essential experience with the most recent problem. Including, if you can create large month-to-month money, thought a smaller name. You are able to will end up purchasing less money.

Repayment safeguards giving you reassurance. Insurance coverage items like these ensure that money can be made, despite days of private and financial issue such as for instance crucial infection or redundancy. Talk to a broker should you want to discover if or not it might possibly be good for you.

Resident Financing that have Pepper Currency

Secured citizen finance is a popular option for those who can meet the fresh new criteria. But it’s also essential to take on all solutions.

Keep in touch with a monetary agent or a mortgage broker who can bring recommendations which help the truth is ideal mortgage for your requirements.