Just what are credit ratings and you may exactly what assortment is recognized as higher level?

Highlights:

- Basically, credit ratings away from 800 and you can more than are considered to settle the excellent variety.

- No matter if there isn’t any unmarried number you to definitely guarantees a debtor access to this new borrowing from the bank, credit scores regarding the higher level range might have a simpler date protecting financing than just individuals with all the way down ratings when trying to get brand new account.

- When you are operating towards sophisticated credit scores, you’ll need to expose positive monetary habits such keeping up in financial trouble money and you can meticulously monitoring your own credit reports.

Fico scores about advanced level diversity are often reported to be low-risk consumers. Because of the installing in control financial activities – and you will doing such patterns continuously throughout the years – expert fico scores tends to be inside your arrive at.

Credit scores is actually around three-digit numbers, normally ranging between 3 hundred and you can 850, designed to portray your own credit exposure, and/or likelihood you are going to spend your expense punctually. Credit scores are made in line with the pointers registered in your credit reports. pay day loans online Cordova AL Lenders consider carefully your credit scores as a whole grounds when deciding if or not to provide credit. They may plus reference their credit ratings whenever form the eye cost or other conditions for the credit they material.

Loan providers provides different criteria to have approving credit, but most individuals remember credit scores in a similar way. Lower fico scores have a tendency to suggest a top-exposure debtor having struggled which have repaying credit inside for the past. Those with low scores could have difficulty delivering passed by an excellent financial or end up facing highest-rates or other negative conditions. High credit ratings will recommend a decreased-exposure debtor which have a track record of positive borrowing from the bank conclusion. They is prone to feel accepted for new borrowing.

There are many different scoring designs familiar with estimate your borrowing from the bank score. not, in the most common rating activities fico scores near the top of new variety (generally 800 and you will a lot more than) are believed sophisticated. Borrowers that have advanced fico scores routinely have a knowledgeable threat of protecting the newest borrowing from the bank a maximum of beneficial terminology.

What’s the normal credit score assortment?

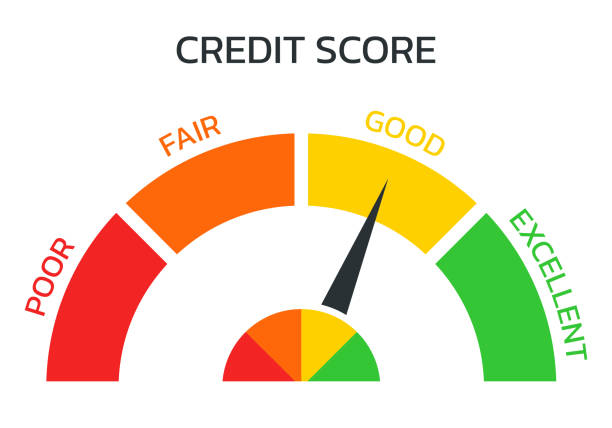

Extremely credit reporting formulas kinds credit scores to the multiple teams, which are after that ranked according to risk. There are numerous rating models used to assess your borrowing ratings. not, really range are like another:

- Excellent (800 to 850): Lenders generally glance at these consumers because the less risky. Thus, someone contained in this diversity may have a less complicated time being accepted for brand new borrowing from the bank.

- Pretty good (740 so you can 799): Pretty good fico scores reflect constant self-confident borrowing behaviors. Lenders will probably approve consumers within variety.

- An excellent (670 so you’re able to 739): Loan providers might think double prior to offering the brand new borrowing from the bank to individuals during the it range. In the event that recognized, borrowers with good credit ratings may deal with higher rates of interest than safer borrowers that have high fico scores.

- Fair (580 to 669): Consumers which have fico scores inside assortment will often have a history out-of poor credit behaviors. This is why, loan providers is generally unwilling to offer the newest borrowing.

- Terrible (three hundred so you can 579): Consumers having poor credit results are considered extremely risky and generally are unlikely to-be passed by a lender.

Look for What are the Different Selections regarding Credit scores? for much more more information how credit ratings was classified.

Advantages of having a beneficial credit score

No matter if there’s absolutely no solitary count one pledges a debtor accessibility new borrowing from the bank, advanced level credit scores will normally give you a plus whenever implementing for brand new levels. Additionally you can get be eligible for higher borrowing limitations with the revolving borrowing levels, for example playing cards and personal credit lines.

There clearly was a giant benefit for your bank account, too: Your debt is more affordable just like the lenders use your credit score setting rates to own fund. Expert credit scores may meet the requirements your to possess handmade cards and almost every other revolving credit profile that have lower yearly fee rates.

Steps so you can reach excellent credit ratings

- Build quick repayments. For the majority credit rating designs, percentage records has actually one of the several has an effect on on your own fico scores. So, one of the most reliable a way to increase your credit ratings is to keep up with your debts. Prioritize and make your repayments punctually, each and every time.