Navy Federal Borrowing Relationship mortgage costs today

Mortgages is generally gotten to possess properties nationwide. Navy Federal Borrowing from the bank Partnership attributes mortgages on lifetime of brand new financing. They don’t really promote member mortgage loans to many other finance companies otherwise companies. The financing connection also offers various apps to own experts and you will basic-time buyers.

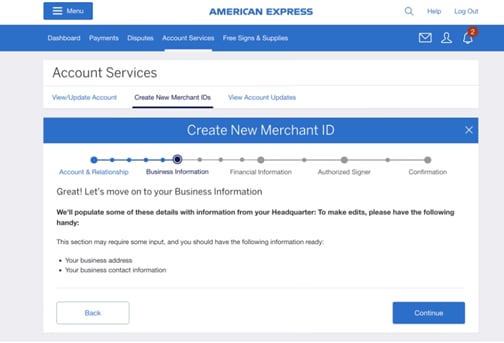

Nfcu refinance pricing can save you cash on the re-finance. He or she is exceedingly flexible so you can energetic obligation army just who is generally stationed in the future. (Photo/Wikipedia)

However some loan providers take into consideration low-traditional forms of credit history, including the amount of towards the-go out rent money, Navy Federal Connection takes it one step after that. This credit relationship together with investigates electric and you may mobile money when choosing a good borrower’s eligibility and you may pricing. This will be very helpful for individuals so you can support the reduced rates, and in turn save money along the long run.

New estimates offered on the Navy Federal Union’s site commonly designed prices because of the geography, credit score, or other advice. Locate current and you can designed rates for the financial predicament, you will have to phone call Navy Government yourself.

How come Navy Government Relationship refinance pricing compare to almost every other banking companies?

USAA compared to. Navy Government: Researching those two military-centric loan providers is a fantastic solution to find out how the armed forces updates can impact the financial rates. Both organizations tout the lowest pricing due to their members, and you can each other loan providers perform 50 % or maybe more of the mortgage business through the Va.

One to important factor to consider before refinancing ‘s the settlement costs. And you will face to face, Navy Federal are unable to take on USAA about front. USAA even offers zero percentage IRRRL and you will a reduced origination fee. (Already, Navy Government charge good .50 percent. higher origination percentage.)

Navy Federal Borrowing Connection versus. Nationstar : If you like an individual connection with your financial, Navy Government will make way more experience due to the fact a lender than just Nationstar. Already, Nationstar has no branch urban centers, which could make they harder to play an effective buyers/financial matchmaking. With respect to tool comparisons for every single facilities attempts to show it’s individual flare. Nationstar targets user books they give a number of homeowner units and academic advice. Navy Government takes a monetary incentivization position they give a great $1,100000 home loan rate fits program.

Navy Government Credit Connection Geyserville loan versus. Wells Fargo : Even if you meet the requirements getting a specialized borrowing from the bank union including Navy Federal it’s worth contrasting exactly how a nationwide lender stacks up. If you are currently, an effective Wells Fargo users your lined re-finance alternative which means zero settlement costs or software and you will assessment fees on consumers. It will help counterbalance the will set you back out-of refinancing, which will make up the huge difference regarding less complete appeal rates finally. Navy Federal does not currently promote an improve equipment.

A lot more considerations to choose in the event the a Navy Federal re-finance is actually for you

People is also refinance the financial that have Navy Government Borrowing from the bank Partnership for to 97% of the home’s financing so you can worth proportion. Very traditional mortgage loans none of them the brand new consumers purchasing private home loan insurance. No pre-percentage penalty charges use for individuals who spend your own mortgage of very early or propose to refinance again.

FHA fund bring some other affordable mortgage choice. Navy Government Borrowing Union also provides FHA mortgage loans as the a great refinancing option also when your first mortgage try that have an alternate bank. FHA mortgages require the lowest down-payment, causing them to an appropriate selection for numerous borrowers. The borrowed funds amounts readily available count on the spot of the property. FHA funds tend to make it a great deal more flexible mortgage degree criteria.

You’ll have to examine loads of guidance ahead of paying off towards most readily useful re-finance device to you. Have fun with a mortgage calculator to incorporate right up most of the will cost you regarding a refinance: closing costs, the interest rates and you can monthly payments. You might be astonished observe you to actually a financial which have large closing costs can help to save the most currency across the way of one’s mortgage.