The ultimate self-help guide to mortgage brokers around australia

The ultimate self-help guide to mortgage brokers in australia

If you are like any Aussies, buying property try a captivating phase in your life. In the near future, you’re possess a place to phone call their – and that is one thing to enjoy.

Meanwhile, it should be one of the most exhausting procedure it is possible to experience. That’s because, unless you are an experienced assets expert, it’s likely that you happen to be diving to the an entirely unknown arena of possessions dealings, lenders and you may home loan repayments.

Your property is likely to be one of the largest requests, if you don’t the greatest purchase, you build in your life. And if it comes to taking home financing, acquiring the best recommendations which help is also actually rescue thousands, otherwise tens of thousands of bucks.

When you are navigating the industry of lenders seems challenging and you may needlessly difficult, is in reality very quick once you learn the basic principles. This is exactly why we’ve developed this informative guide, that covers everything you need to understand lenders inside Australia.

Of understanding the different kinds of mortgage brokers available to choose from so you’re able to a step-by-action summary of the borrowed funds application processes, we shall give you what you need to make correct call for your residence mortgage.

What’s a mortgage?

Home loans are financing supplied to your from the a bank otherwise lender, in order to make it easier to buy property.

To help you safe a loan, you will need to features in initial deposit with a minimum of 5%, while the mediocre Aussie fundamentally keeps a good 20% deposit. Your own financial next gives the rest of the currency to help you buy the home, which will be anywhere around 95% of your cost. At exactly the same time, there are lots of additional can cost you to take into consideration, such as stamp obligations, conveyancing and you will court costs.

When you sign up for a mortgage, you’ll have to generate normal repayments weekly, fortnightly or monthly, over the amount of the borrowed funds name. In australia, mortgage conditions fundamentally may include 25-30 years, depending on how much you borrow and just how quickly you can make money.

Various can cost you that comprise your house loan

A home loan is approximately more than just credit currency to pay back your home. There are lots of other can cost you to cause of – all of which apply to exactly how much you’ll be settling more the class of your own mortgage.

The primary

This is actually the number which you have borrowed to buy your household as well as have to invest back once again to the lender. The principal amount reduces through the years since you repay your mortgage.

Instance, if you have a good 20% put to the a home you to definitely will cost you $one million, the original principal count will be $800,000. If you’ve currently repaid $100,000 thereon loan, the remainder principal count would-be $700 cash advance, Merino, CO,000.

Home loan interest

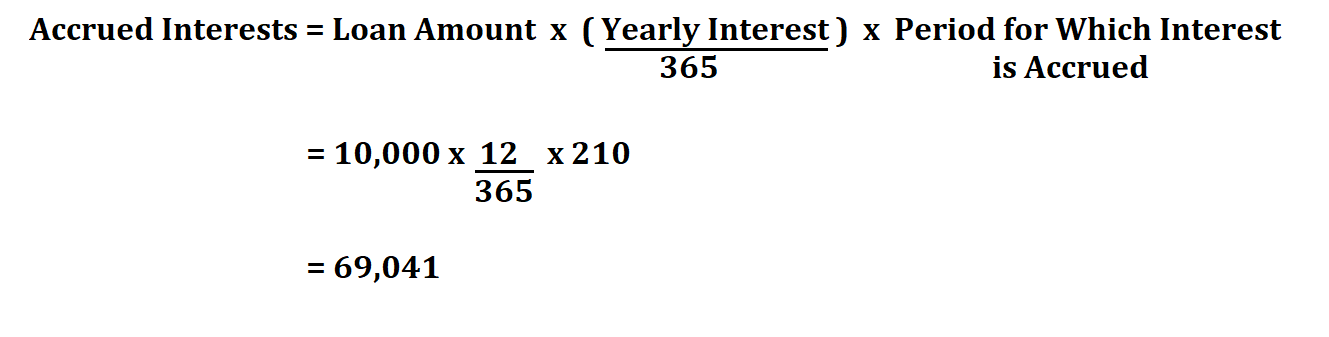

Interest levels is the prices a lender fees you on your own principal that is determined as the a portion of your l matter that you lent about bank.

Because mortgage interest rate may appear such as good small group, this number can add up over time while the interest is calculated into an every day basis.

The average Australian looks like purchasing nearly the expense of the brand new home in notice by yourself, this is the reason its required to find the right mortgage product available and comment they all the couple of years.

Bank fees and you will costs

On top of the principal and desire, there are many fees and you will charge with the taking out fully an excellent financial. Such differ based the lender.

- Month-to-month Account-remaining charges,