This new bane away from loan officers, processors, and you will mortgage underwriters every where, it can be sorely boring having potential housebuyers, also

Advantage verification, if you are not packed with assets, would be an invasive processes. When you yourself have large form, with a few hundred or so thousand dollars remaining just after your down-payment, you will not obtain the same inquisition top as other people. The original-go out client, with rarely adequate currency for a long visit to IKEA after they personal, can get an even more official query than their coming-more successful-selves can expect.

If everybody else detests resource verification, once the trained because they are extremely towards document-reigned over weight of getting a mortgage, it must be crappy. So why is it complete? As the lenders must make sure which you have adequate money to pay for the down payment as well as your closing costs.

Men and women are somebody, in addition to their economic conclusion reflects one to. Anybody from time to time overdraw. Anybody sometimes do not know in which that $287 cash put originated in, just. Sometimes they know precisely where one $287 cash deposit originated from however, prefer that lender perhaps not know-no matter if being unsure of means its financing approval will be at risk.

Do not blame the loan manager, who’s just following assistance if they have to ensure the assets. The best highway, on the the very least quantity of discomfort, should be to comply. Here you will find the designs you will want to prevent and should embrace to help you make the processes simpler and you can rates the application on its way to recognition.

Trick Takeaways

- Loan providers need to make certain the assets to possess a mortgage to be certain you have money to spend your down payment and you can any required supplies.

- Cash is difficult to shade and may even perhaps not matter due to the fact a keen advantage when the the supply can not be verified.

- Charges for nonsufficient fund and overdraft fees is red flags in order to loan providers.

- Many fund make it current loans, nevertheless they must also getting confirmed.

What is Sensed a secured item?

Property are basically any fund or expenditures which you have offered to you personally. They had been your own internet value. They can be out-of the following the present:

- Checking account

- Coupons profile

- Cds

- Money sector profile

- Senior years accounts

- Broker accounts

The fresh Dangers of money

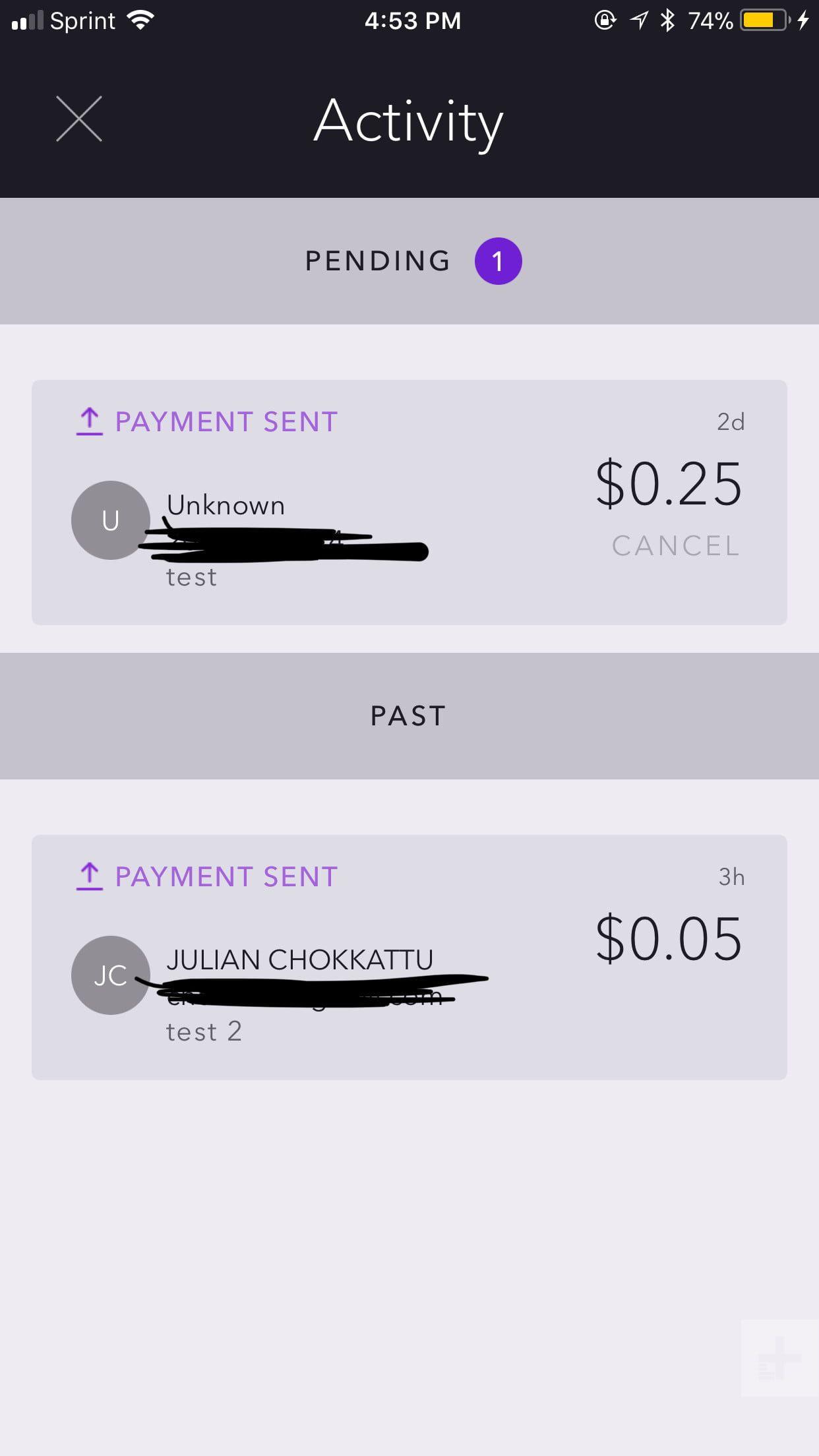

![]()

Lenders find out if every possessions your listing on your loan application is affirmed and properly acquired. This is accomplished by looking at both current comments for people profile on the app. Whenever evaluating the new comments, all of the put-no matter what small-must be verified as to their source.

Loan providers dont work at untraceable funds from a debtor. That frequently ensures that bucks dumps for the a free account can not be used. Dumps of cash can taint the complete account in order for not one of cash in that membership are used for the acquisition of the home.

When your habit would be to bucks the paycheck, shell out their costs with the bucks, and put the brand new kept money with the bank, stop right now. Put your check into the lender, or take out just exactly what cash you want so that you haven’t any dollars dumps going into your finances.

Dents because of the Nonsufficient Fund

A lender reviewing their financial comments can refuse the borrowed funds if the you can find prices for nonsufficient finance (NSF) or overdrafts to fund Automatic teller machine withdrawals otherwise inspections your had written into this new membership. A financial will not give you currency for those who have numerous NSF charges otherwise overdraft charge on the account. If you had two case which can be informed me from inside the a page, that would be excusable, but a period of those directs up warning flag. Thus remain a cushion in your membership, and stay near the top of their balance.

Issues with Gifts

You need a cash current of a close relative, workplace, or intimate personal friend to help https://paydayloansconnecticut.com/old-saybrook-center/ with a down payment otherwise settlement costs, but on condition that the individual supplying the gift can be that the cash was in a checking account ahead of bestowing it on you. Like your own assets, merchandise need to be confirmed and out of a let supply. It is preferable in the event your donor’s financial declaration does not include large places quickly till the date of your own withdrawal; whether it do, men and women dumps including need to be sourced, and/or current will never be welcome.

Plus a financial declaration on the donor proving the latest money provide, attempt to promote facts your provide gotten, eg a copy of your own consider, and you also should provide evidence this new present might have been deposited on the your bank account. Usually, a lender statement exhibiting the fresh put commonly serve.