To the correct loan, you can repay your wedding day and just have into the with lifetime

You would like a unique set of wheels? Are you spending more time split otherwise wishing regarding repair center for another costly repair? Perchance you need to change in order to a much bigger car for your broadening members of the family, or perhaps downsizing into things shorter which have top gas mileage?

With one biggest buy, the method that you plan to pay for you to definitely purchase is a significant choice. With the cost of new vehicle costing over $twenty five,000, financial support an automobile buy are practical.

Whether it’s yet another otherwise pre-possessed purchase may also always regulate how far interest lenders will ask you for to finance the mortgage.

There are an effective way to safe money for a different car get. Traditional loan providers like your local financial or credit partnership provides advanced level costs to own car commands however, need that be a part.

Many vehicle dealerships bring capital as a result of vehicles manufacturers, with online shopping remaining popular to own customers, bringing preapproved for a loan is fast and easy. Deciding on the best financing for your forthcoming automobile get could possibly get you straight back on the go and you may save thousands of dollars along the way.

#step 3 Pay back Your wedding

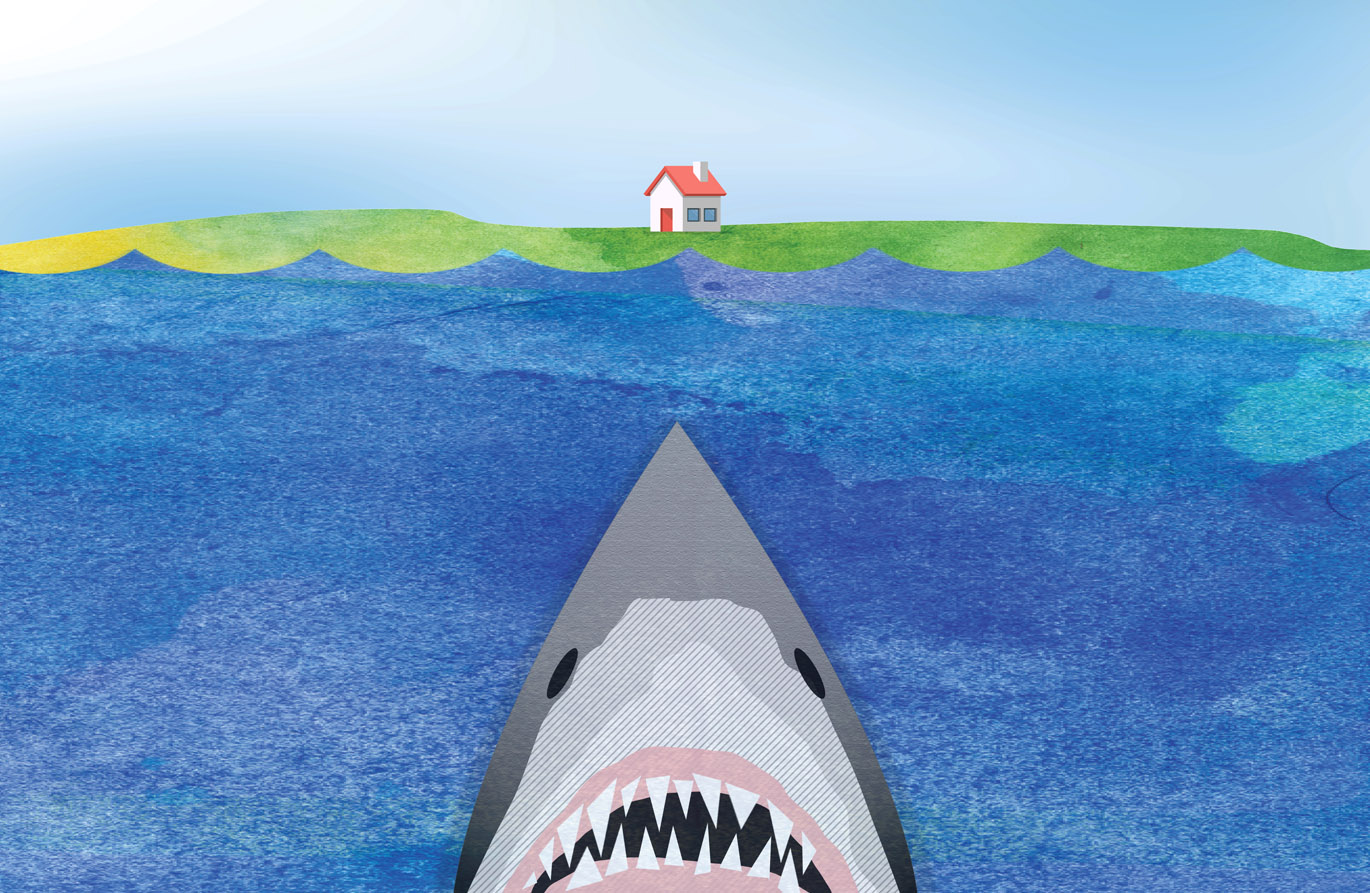

Saying I do should not give you drowning in debt for the next 10 years. Do you purchase too-much on the providing at your wedding? Do you travel world-class towards the vacation attraction? Perhaps, brand new ring on reception recharged per hour and not because of the concert?

No matter what cause of your wedding financial obligation, offered an unsecured loan to pay off the debt could be a smart proceed to provide headed throughout the correct recommendations.

Shedding at the rear of or shed costs try a negative effect, and you will regrettably, can lead to next harm to the credit or even taken care of in a timely manner.

Whether or not you energized everything using one bank card, several credit cards, or are obligated to pay other dealers, taking right out a personal bank loan makes it possible to pay back several expenses and then leave your in just one to percentage.

Getting married is actually stressful sufficient, however, getting later on the expenses is not necessarily the most practical method first off your brand-new life. Money problems are probably one of the most preferred explanations you to definitely marriages falter. It may be bad economic decisions, you to definitely partner’s purchasing activities, otherwise dropping a career.

#4 Upgrade Your property

Leaky roofs and dated appliances is actually frustrating getting homeowners, but therefore is the cost of building work your home. Uncertain occupations segments and you can a challenging national medical care disaster makes of many reconsider selling a home and get alternatively picked to modify present areas.

That have online lookup readily available for people procedure and common family restoration suggests simply a click away, doing-it-on your own has Kentucky installment loans become ever more popular all over the country.

Whether it is an update so you’re able to this new home appliances or renovations new downstairs toilet, residents is always to research and get the right general specialist due to their need.

Renovations a house may seem such an easy move to make, but unless you provides a good amount of experience undertaking programs up to the house, you need to most likely log off the difficult content on gurus.

Seeing a good YouTube video clips towards the setting-up a dampness burden would be an easy venture to accomplish, but if you get it done wrong, it might ask you for thousands of dollars during the fixes when your investment springs a drip.

The same goes for getting just the right mortgage to simply help pay for or funds your house improvement venture. To your best financing, you might redesign your property, eliminate the anger, and you can spend more day that have family and friends.