When shopping for a specialist, make sure to check that he is up to date with insurance, skills, and you can licensure

There’s no doubt that concept of domestic home improvements is going to be fun. Imagining a freshly lengthened home, deluxe restroom, or other extreme restorations investment, could keep you daydreaming throughout the day. And even though which is every better and you will good, it won’t improve actual renovations one convenient otherwise less. For the organization out-of providing their daydreams alive, because of the cost is actually a surefire cure for promote on your own straight back to facts.

Saving upwards for domestic renovations are overwhelming, especially since everybody knows that also a somewhat short investment normally spiral to the anything much bigger and more expensive. Which have a discount plan and you can understanding your investment solutions is key prior to people renovation conclusion. DCU has arrived to help you having tips on knowing the price of renovations, adjusting your funds, trying to find contractors, and finding the best loan and you can borrowing from the bank options.

It isn’t an easy task to help you estimate the expense of restorations given that parameters such regional areas, procedure supply, their home’s status and you will work will cost you should be extremely other dependent on the where you live. That said, carrying out a little research towards after the key factors is certainly going quite a distance with the picking out a solid prices guess to own beginning the fresh budgeting techniques.

- Materials: The cost will not be devote stone up to builders get embroiled, but select and find the values of information your want to use for the renovation. Include what you can contemplate, from case methods so you can flooring so you’re able to products.

- Labor: Builders probably will never be advertising its work rates themselves website, but looking up labor costs for assembling your shed input their area can provide a great ballpark estimate.

- Scope: Identifying new details of the investment will help maintain your estimates reasonable. Eg, knocking down or strengthening wall space should be costly, therefore once you understand in the beginning what you’re willing rather than willing relating to the restoration could keep a great encourage-of-the-time decision away from costing you big style afterwards.

- Surprises: Even after delivering designers on it, you will find usually amaze can cost you throughout the renovations. Contrasting every little thing that go awry or crack wouldn’t be much assist for your budget otherwise your head, however, expecting certain surprise expenditures can assist maintain your standard and you may finances practical.

Build Improvements to the Current Finances

Once you’ve settled toward crude expected cost of the family recovery, it’s time to take a look at your finances and you will figure out where you are able to start saving or putting away currency to possess your panels. When you’re reducing all of your current amusement financing isn’t really necessary, securing their paying can make the method much faster. Tips about a knowledgeable an effective way to save money for the recovery are:

- Dump activity costs. Although this is rarely a giant amount of cash most of the at immediately after, limiting your own night over to the movies, recreations, shows as well as this new streaming properties you have to pay to own might be an effective starting place saving cash for the repair.

- Eat at home more frequently. You don’t need so you’re able to dump dining altogether, however, are trying to plan and you can consume much of your meals yourself allow you to allocate extra money towards the upgrade.

- Express your vacations. Avoiding air travel and you can hotel stays will keep tons of money on your wallet!

- Indicate your deals. Setting-up a savings account specifically for your residence recovery will help you recognize how romantic youre for the mission number. Opening a top-give family savings (or something like that equivalent, like a certificate regarding Deposit) will grow your money because you save yourself, definition you’ll struck your ultimate goal smaller!

Find competitive (however, high quality) builders

Try not to choose the first contractor you talk with. Rating offers from a number of well-analyzed builders with done work with your neighborhood so you is also contrast cost. Don’t neglect to inquire about timeline prices to ensure neither your neither brand new builder is actually hurried for the hasty conclusion otherwise cutting sides.

This will help inside the weeding away contractors just who could leave you large and you can inactive which have an unfinished project or poor workmanship.

Need money responsibly

Protecting if you don’t can pay for your residence home improvements within the cash can be fulfilling, but it also can take more time than simply you’d like. Using a variety of a great budgeting models and that loan is a reasonable way to achieve your renovation wants in your schedule.

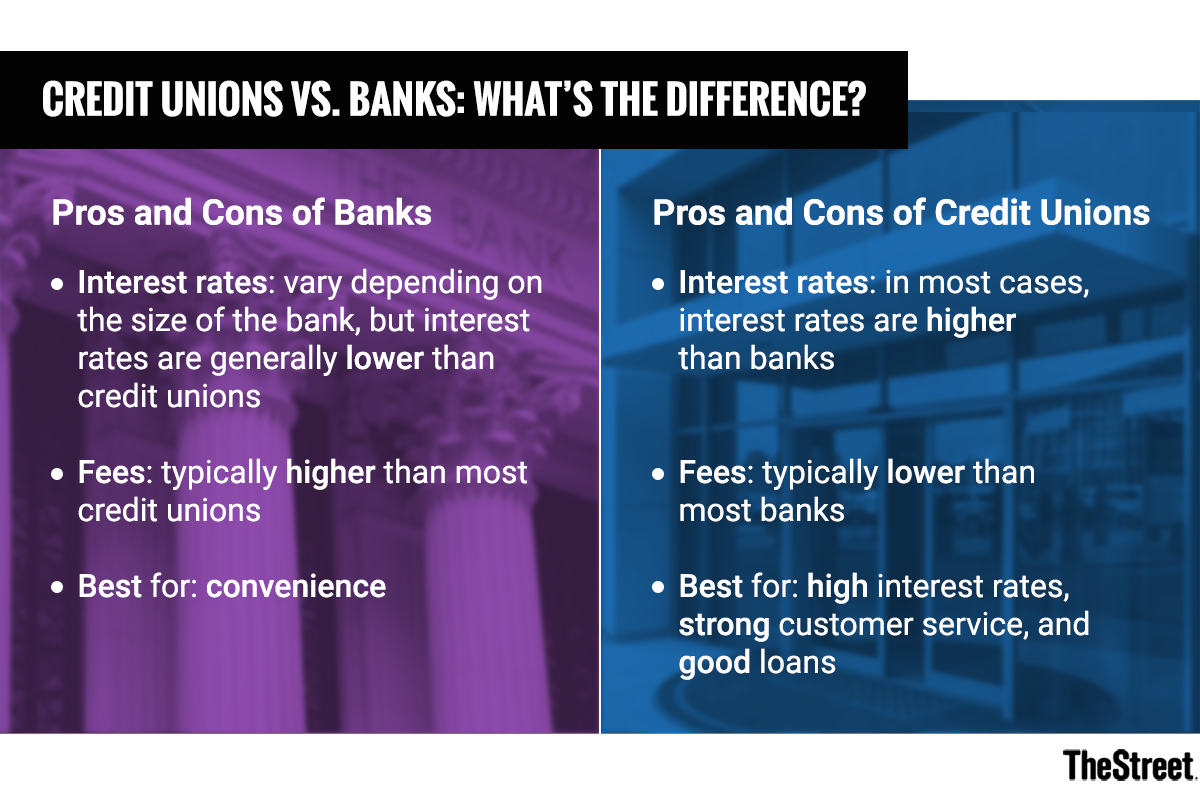

There are various financing sizes you can get, for example an unsecured loan or do it yourself loan, however, a fixed-rate household security financing otherwise domestic collateral credit line (HELOC) are two advanced level options for people. One another repaired-price domestic security money and you may HELOCs allow you to borrow against your residence’s security to fund higher purchases – such as for example domestic renovations. Typically, interest rates for repaired-price domestic collateral funds and you may HELOCs are difficult to beat, however, whatever the mortgage alternative you choose, definitely discover the combination of terms and you may capital matter that is effectively for you and your members of the family.

Household equity loan

A house collateral loan offers a-flat amount of cash upfront. That one is useful once you know how much cash the restoration will surely cost and you will what portion of assembling your shed you would like to cover with coupons compared to. on financing. Household security money try reduced more a fixed title in the a predetermined rate of interest and you can payment.

Home collateral personal line of credit

HELOCs much more versatile, providing you with a credit limit that you could borrow against during a precise draw months. If you find yourself harder to cover, when there is some doubt regarding price loans in Buena Vista of your panels or you are considering starting more really works, good HELOC gives you the capacity to pay without needing to sign up for a completely the mortgage. In the event that mark several months stops, new installment several months starts. HELOCs possess varying rates which can vary over time.