Would it be hard to get accepted for a tx FHA financing?

These pointers reflect the fresh FHA’s dedication to making owning a home possible, while also making certain funds are provided to prospects who happen to be going to manage the mortgage payments. That it equilibrium support activate this new housing marketplace and you may protects against the risks of the loan defaults.

FHA Assets Standards Told me

FHA financing wanted property in order to satisfy certain requirements to ensure they was secure, safer, and you may structurally voice. So it besides covers new borrower and also protects the latest lender’s financial support. Here you will find the key elements reviewed:

- Roof: Need to be intact instead leakages, destroy, otherwise missing shingles.

- Foundation: Shall be secure, height, and you may free from high breaks or the need for big fixes.

- Electric and Plumbing work Systems: Should be totally practical and compliant having newest rules.

- Heating and cooling Expertise: Is operate safely and effectively.

- Interior and you can External: There has to be zero major architectural damage otherwise health hazards, like direct painting, no really serious use of circumstances.

- Appliances: Essential equipment, particularly ovens and you may range, must be in operating standing.

It is vital to note that FHA conditions focus on the residence’s extremely important capability in place of their visual attract. When you find yourself lesser repairs or condition could well be necessary, they generally dont disqualify a home out-of FHA approval.

2024 FHA Mortgage Restrictions inside Tx

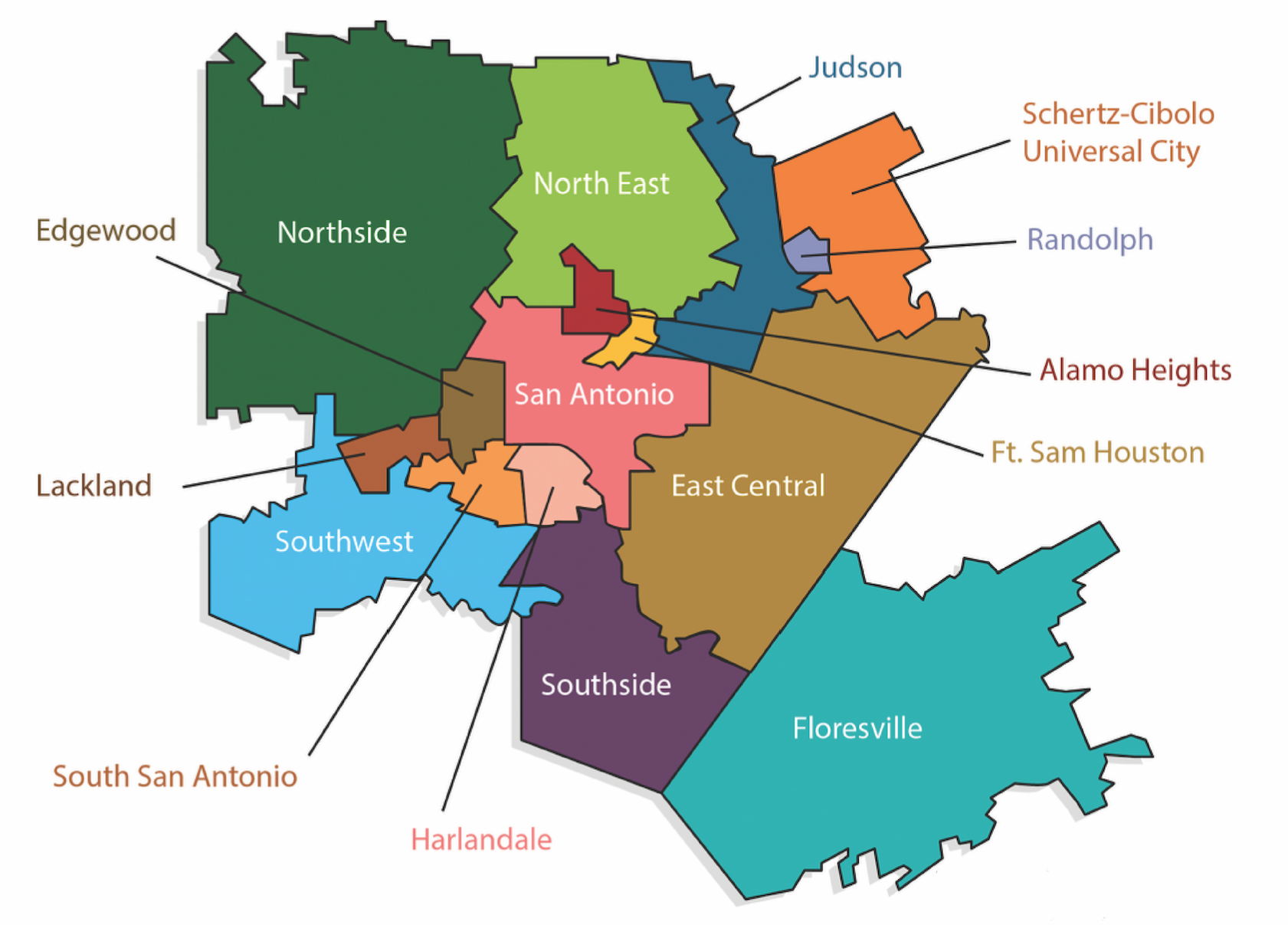

Inside Colorado, the maximum amount which are often borrowed with a keen FHA loan varies by state which can be modified annually predicated on value of alter. These differences have been called FHA Loan Limitations. To have 2024, most areas in the Tx enjoys lay the utmost loan amount for single-relatives residential property within $498,257. not, within the high-costs areas, the mortgage limitations are increased. While doing so, a full amount borrowed cannot surpass 115% of your own median household speed regarding the respective state.

Faqs

Its basically better to get approved to possess an an FHA financing now as compared to a normal financing because of all the way down credit score requirements, lower down commission, together with ability to meet the requirements despite past economic points. FHA funds also offer down rates of interest to help with monthly costs.

Just what places does Herring Financial promote FHA Loans into the Tx?

Herring Bank provides FHA Finance during the: Houston, San Antonio, Dallas, Austin, Fort Value, El Paso, Arlington, Corpus Christi, Plano, Laredo, Lubbock, Garland, Irving, Amarillo, Huge Prairie, McKinney, Frisco, Brownsville, Pasadena, Killeen, McAllen, Mesquite, Midland, Denton, Waco and a lot more!

What’s the disadvantage to a good FHA mortgage during the Texas?

The latest downside to an effective FHA financing comes with an extra cost inside the the type of an upfront mortgage top, that will be either paid-in cash at the time of mortgage or rolling towards longevity of the borrowed funds, in addition to household rate being qualified maximums set by FHA.

What is an FHA loan and exactly how will it performs?

A keen FHA loan is a type of mortgage covered because of the Federal Homes Management, enabling you to build a minimal downpayment and have quicker limiting borrowing conditions than just conventional mortgages would. The federal government means the latest FHA financing, causing them to better to qualify for and you may demanding home loan insurance coverage.

Which are the head advantages of choosing an enthusiastic FHA loan over antique money?

Going for an enthusiastic FHA loan can provide reduce payment criteria, alot more versatile credit history standards, while the choice to have fun with gift money to own off repayments, offering extreme advantages of basic-day homeowners and people which have minimal savings otherwise credit challenges.

- Foreclosures Healing Period: Usually, candidates have to be three years regarding foreclosures and then have lso are-oriented a good credit score so you’re able to qualify. Conditions can be considered under extenuating affairs, regardless of if simply relocating to a unique town being incapable of sell the earlier home does not qualify no wait cash advance Hartman CO. This coverage encourages responsible credit explore following the high financial worry.