You do not always must be a person in the brand new army to visualize a Virtual assistant financing

Disadvantages from assumable mortgages:

- For Buyers: You should however make an application for the mortgage and you may satisfy their demands, restricting the selection of loan providers. You do not have the blissful luxury away from looking around to own a loan provider because you will must be acknowledged to own, and take toward regards to current financial.

- For Consumers: As stated prior to, if your vendor keeps reasonable domestic equity, you’ll likely need certainly to put together the bucks for a life threatening downpayment, which could be a financial problem.

- To have Customers: In the event that a supplier is aware of the desirability of the home by assumable mortgage, this could increase interest in our home and permit them to increase the cost, deciding to make the provide process alot more competitive. Given that a buyer, we wish to be cautious never to overpay with the house to the best intent behind inheriting the mortgage. It is a smart idea to estimate the newest monthly installments for all the belongings you are looking at observe how they evaluate.

Style of Assumable Mortgages

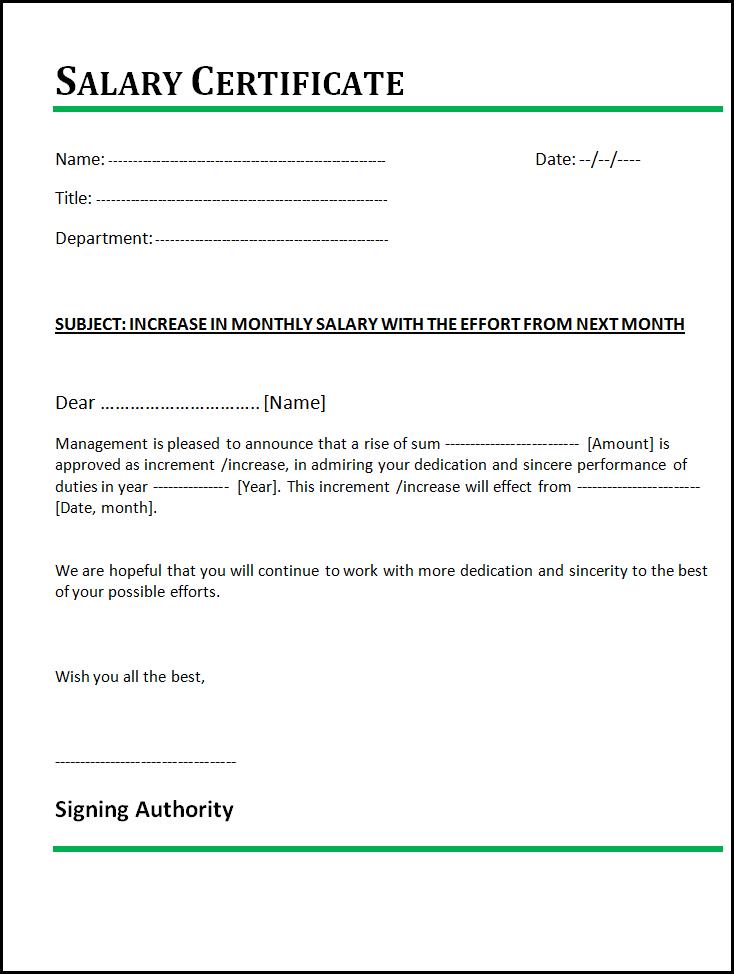

To assume a keen FHA mortgage, you ought to meet the important FHA financing requirements, that can are and also make the absolute minimum deposit away from step 3.5 per cent and having a credit rating with a minimum of 580.

It’s important to note that antique funds are usually maybe not assumable, except for the specific facts, instance just after dying or divorce proceedings.

Simple tips to Guess a mortgage

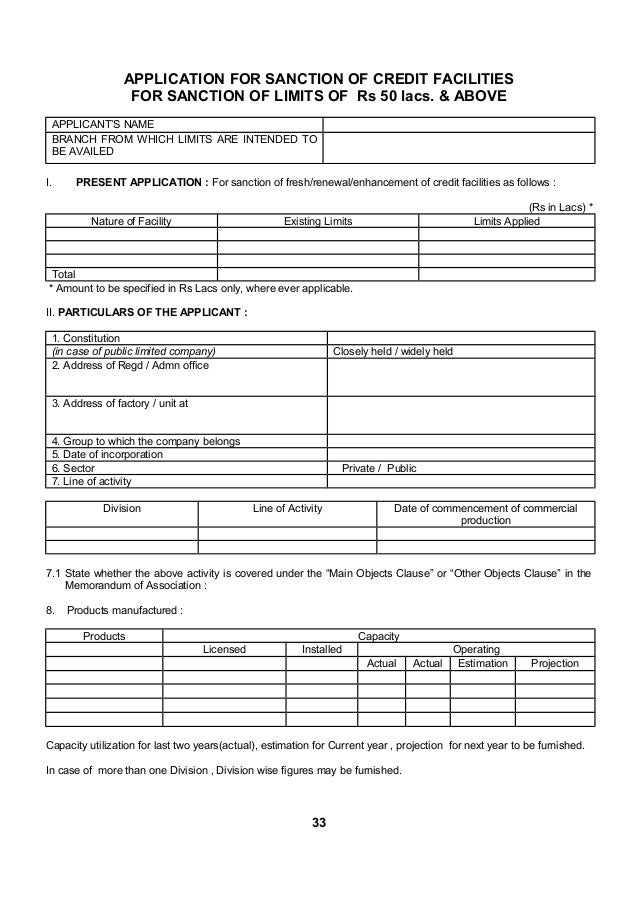

Prior payday loans San Antonio to whenever home financing, you must get recognition from the unique lender. This normally involves conference a comparable standards since obtaining a regular financial, like a qualifying credit history and you can a low obligations-to-money ratio. Here you will find the general measures to check out:

- Prove Assumability: Be certain that whether or not the loan is assumable and you can consult the current home loan holder’s lender to be certain it permit expectation. You may want to first need in contact with the vendor so that you can have the contact information towards the new financial.

- Get ready for Costs: Find out the remaining equilibrium into financial which means you does this new mathematics into cash you will need to provide closing. If you think the remainder balance will need extra financial support, start shopping around to own lenders that offer that and understand brand new terminology (observe that this will vary to your current rates of interest, plus they are less good terms than the mortgage you is actually and when)

- Sign up: Fill out an application, render requisite models, and complete identification. The processes may vary depending on the financial.

- Close and you will Indication Launch of Liability: While the presumption of mortgage has been acknowledged, you are addressing the past stage of procedure. Similar to closure some other financial, you’ll want to finish the requisite documentation to make certain a flaccid changeover. You to definitely very important file very often will come in is the discharge off accountability, and this suits to confirm that seller has stopped being responsible towards financial.

With this stage, it is important to pay close attention to the details of your own launch of accountability. Make certain that most of the vital information are accurately recorded, including the brands and contact specifics of both parties, the property address, the mortgage details, and just about every other related information. Looking at the fresh file carefully might help minimize the risk of one frustration or courtroom complications later on.

Think about, the signing of your own release of liability stands for an essential transition for the customer therefore the seller. It scratches whenever when the burn is actually introduced, and also the consumer assumes on complete obligation to the mortgage. From the finishing this task faithfully and you will carefully, you may make a stronger basis getting a profitable and you may legally joining assumable mortgage arrangement.